Listeners to the Car Pro Show have known this for months, but the folks at Edmunds have realized it, too. If you leased a vehicle in 2019, you're in a great position to take advantage of positive equity. That's because vehicles with leases ending this year are worth more than their original residual values. Some more than others. The average 2019 model year leased vehicle has a 2022 trade-in value of $7,208 more compared to the original estimated residual value according to Edmunds.com.

Edmunds recently advised consumers with a lease expiring in 2022 to check on the equity of their leased vehicles so they don't leave thousands of dollars in cash on the table. As Car Pro Show host Jerry Reynolds has also explained in recent months, Edmunds experts also say skyrocketing demand in the used car market is driving up trade-in values. Edmunds says this places a large number of consumers with leases ending this year in an unprecedented position to take advantage of positive equity.

"If you're one of the four million Americans who leased a vehicle in 2019, you could be in quite a financially advantageous position this year and not even know it," said Jessica Caldwell, Edmunds' executive director of insights. "Most consumers likely aren't aware of the other options they have besides turning in their lease once it's over, including the ability to make a profit from their vehicle. If you have a lease expiring this year, do the legwork ahead of time so you're prepared with a game plan and smart financial options."

Edmunds analysts looked at the estimated residual values for 2019 model year vehicles leased in January and February of 2019 and compared those residuals to the trade-in values for 2019 model year vehicles that were traded in during January and February of 2022. Its data reveals that on average, the 2022 trade-in value for all 2019 model year vehicles saw a 33% lift, or an increase of $7,208, compared to their original estimated residual value.

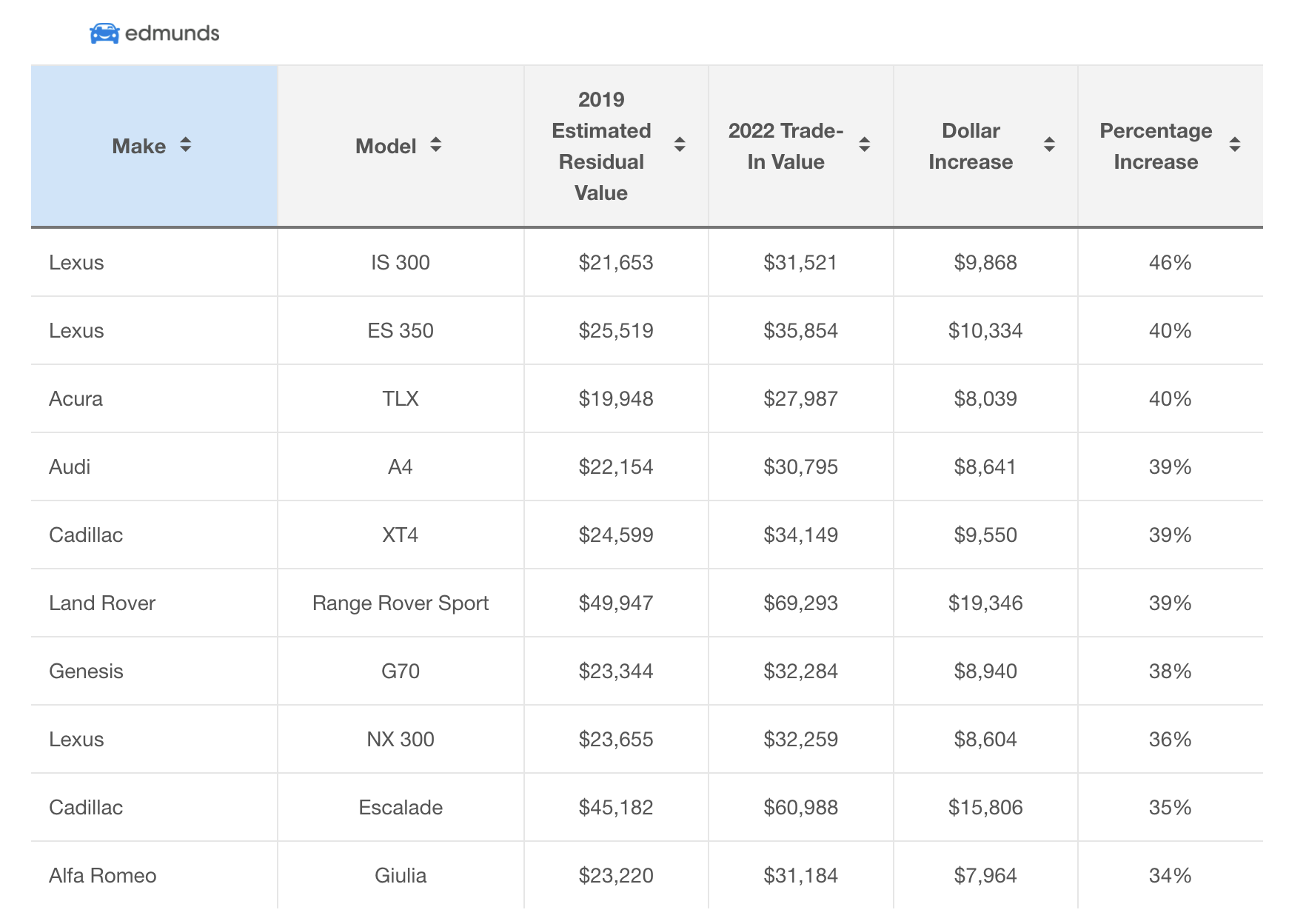

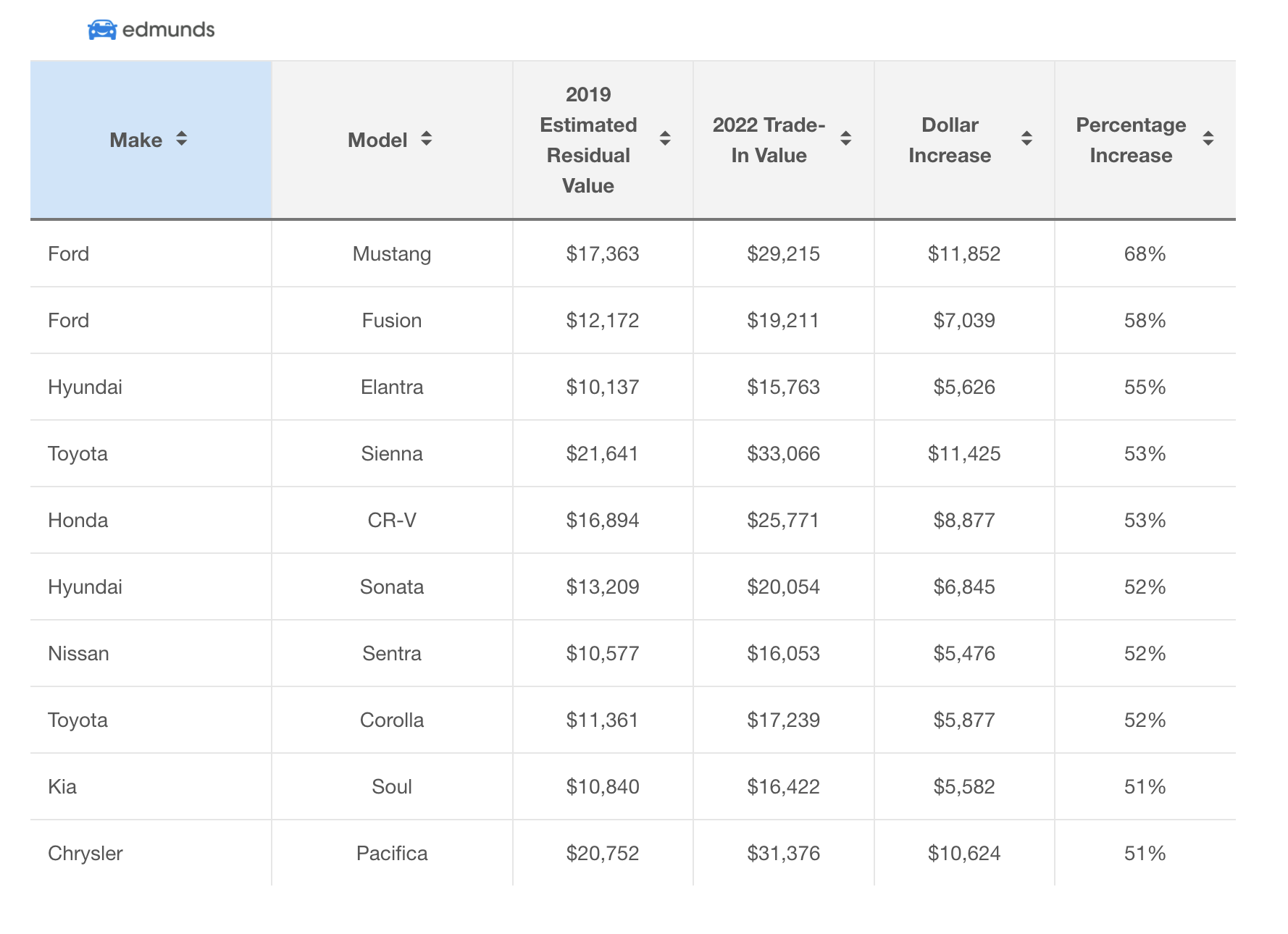

The luxury vehicle with the highest percentage increase is the Lexus IS 300, generating on average 46% more than its original estimated residual value, an increase of $9,868. Edmunds says the 2019 Ford Mustang (pictured above) yielded the highest percentage increase for mainstream vehicles, generating 68% more than its original estimated residual value, an increase of $11,852.

"Unless you've driven an exorbitant number of miles or your vehicle has excessive wear and tear, you're pretty much guaranteed to see an increase in value," said Ivan Drury, Edmunds' senior manager of insights. "The one drawback is that you'll likely have to do a bit more legwork than in the past to take advantage of the equity in your expiring lease given that some auto manufacturers have recently placed more stringent rules on lease purchase options. But taking some extra steps will be well worth it for many, given the financial reward."

To help consumers looking for a place to start, here's a list Edmunds put together a helpful insider guide:

- Find out exactly how much your leased vehicle's payoff amount is. Call your lender to get a value, which should be valid for at least seven days or until your next payment date.

- Find out what your vehicle is worth. Go to a third party (Car Pro Show host Jerry Reynolds recommends Carbingo) and compare that to your leased vehicle payoff amount to see if you potentially have positive equity in your vehicle.

- Find out if your financing company allows third-party buyouts. Historically, one of the easiest ways to make a profit from your ending car lease was to sell your vehicle to a third-party dealership—and let that dealership exercise the buyout. But in light of inventory shortages, a number of automakers have restricted this practice and require that consumers return their vehicle to one of their franchised new car dealerships. In fact, only Toyota, Lexus, Mitsubishi, and Stellantis are not restricting what you can do.

- If your automaker permits third-party buyouts, shop your vehicle around to used car dealers and find the one that will give you most for your car.

- If not, try to sell back the car to the same brand's dealership instead of just returning it at the end of the lease term. Don't be afraid to shop around your car to multiple dealerships if possible. You should be successful, since all dealers are currently striving to increase their inventory.

- If a dealership is unwilling to write you a check for your vehicle, try to leverage the positive equity in your vehicle as a discount on another lease, almost like a loyalty incentive.

- Or buy your lease out yourself and sell it for a profit. An alternative is to secure cash or outside financing for the lease payoff amount, take ownership of the car, and then sell it on your own. But note that this will entail additional costs, including loan fees and interest (if you borrow the necessary fund), and registration and title costs, as well as tax obligations that can vary depending on where you live.

Edmunds' top 10 list for luxury and mainstream 3-year-old leased vehicles that are commanding the highest average percentage increase in their 2022 trade-in value versus original estimated residual value can be found below. (Both graphs below are used with permission from Edmunds.)

Leased Luxury Vehicles Commanding the Greatest Percentage Increases in 2022 Trade-in Value vs. Original Estimated Residual Value (2019 Model Year)

Leased Mainstream Vehicles Commanding the Greatest Difference in 2022 Trade-in Actual Cash Value vs. Original Estimated Residual Value (2019 Model Year)

Photo Credit: 2019 Ford Mustang. Ford.